This Little Known Market “Tip Off” Reveals Tomorrow’s Biggest Winners Early

It’s impossible to spot with the naked eye but it can alert even average investors to which companies are set to soar the very next day.

Here’s how to access this unique new signal that can direct you towards some the greatest profit opportunities of your life.

Dear Friend,

Wednesday July 29th 2015… it appeared to be just another normal day on Wall Street.

The Dow traded over 93 million shares and ended slightly up for the day.

Whole Foods, Kinross and Met Life saw their share prices tumble.

While Facebook made news with a 39% increase in revenue.

Pretty typical stuff on the trading floors really.

But hidden inside those 93 million shares that changed hands…

And buried beneath the major headlines of the day…

A little known market anomaly occurred that made one trader practically a millionaire in a matter of minutes.

Now this anomaly takes place roughly 10-15 times a day inside the markets.

And given that tens of millions of trades occur each day on Wall Street, it’s literally impossible to spot with the naked eye.

But on July 29th, under the radar of 99.9% of the investing public, this trader walked away with profits in hand of roughly $900,000.

I’ll explain…

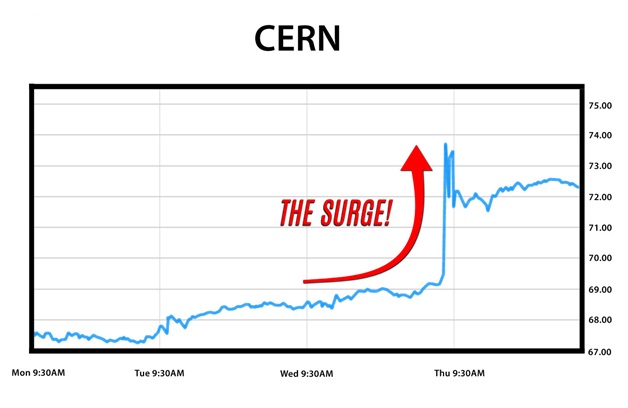

Around 3:40pm that afternoon – 20 minutes before the closing bell rung, word began to circulate that a medical equipment company called Cerner Corp had secured a contract with the Pentagon as part of a $9 billion dollar deal to create an electronic health records system.

In nearly the blink of an eye, Cerner’s stock jumped 6% and ended the day at $73.40 a share, up from its open price of $68.28.

The trader in question didn’t wait till 3:41 PM to make his move however.

In fact he had already positioned himself to make a killing on Cerner earlier that morning.

Did he get lucky? Probably not…

It’s very likely he had some lucrative inside information. But that’s not the point here.

That morning he bought 5,000 Cerner August 75 call options for $0.70 a piece.

And when the stock shot up 6% later that afternoon, those calls quickly flew up to $2.50 a contract.

A 257% gain that handed him profits of $900,000.

So what’s the anomaly here?

Dig deep into Cerner Corp’s data and you’ll see that on average the company only trades 833 total call options a day.

This trader however laid out $350,000 of his money to purchase 5,000 calls.

A bit out of the ordinary wouldn’t you say?

I’d go even further and say it was a big red flashing X alerting those nimble enough to catch this anomaly that something big was about to go down with Cerner.

Imagine if you had seen that X…

Imagine if you’d been able to make a move on Cerner earlier. Even if it was just laying out a few thousand dollars instead of the $350,000 this trader did.

$2,500 turns into $8,925… 5,000 turns into $17,850… $10,000 transforms into 35,700.

In just a matter of hours to boot!

If you’d only seen the signal…

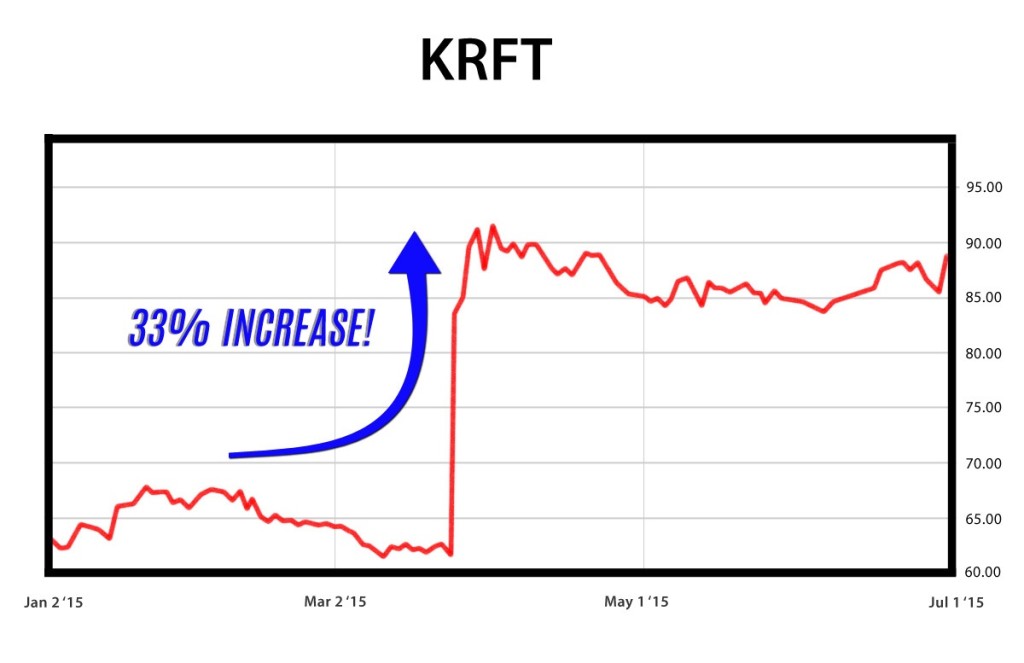

Cycle back a little further, to March 10th, 2015 and you’ll find another one of those flashing X’s sitting squarely on Kraft Foods.

It was on this day that the market saw a trader buy 10,000 Kraft June 67.5 calls for $0.70.

This trade required this individual to lay out $700,000 in capital.

This was clearly not an amateur making this move.

Also just as clear? He had it on VERY good authority that Kraft was about to be delivering some very good news.

This time it took a bit longer for all the cards to lay out – two weeks to be exact.

But it was worth the wait. Because on March 25th Kraft announced a huge merger deal with global food giant H.G. Heinz Company.

Kraft’s stock soared 33% that morning and at its height, that trader’s unusually bullish bet on the company was worth nearly $16.1 million.

And yes, on that day Kraft was front page business news thanks to the merger and its huge price jump.

But 14 days earlier, it’s not likely that very many people noticed this trader buying up $700k worth of Kraft call options.

It was an anomaly to say the least… and one that if you’d caught, could have paid off handsomely if you’d followed suit.

Because even if you’d only purchased 50 of these calls for $0.70 each, you would have profited nearly $78,000 at the highs Kraft hit two weeks later.

$78,000 in two weeks!

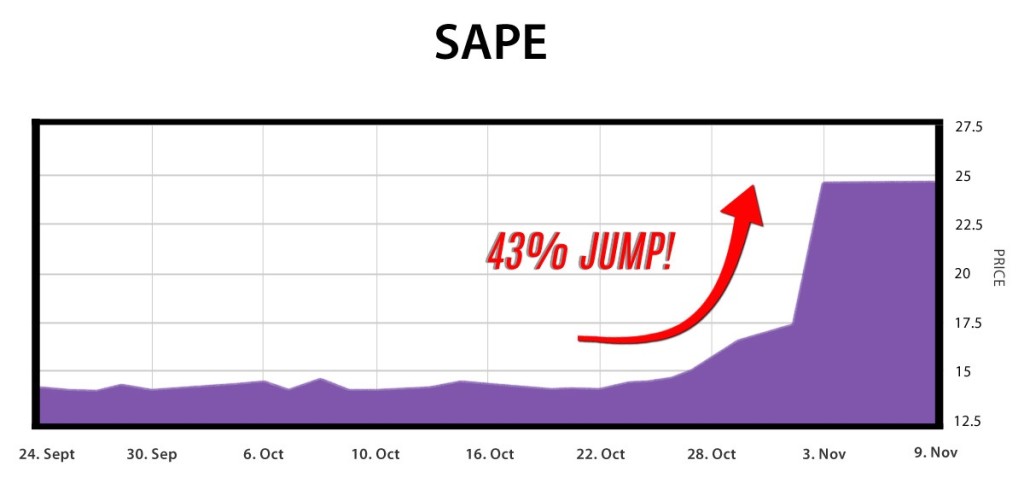

I’ll give you one more example… this time it revolved around a digital advertising company called Sapient Corp.

On October 29th, 2014, an abnormal amount of bullish bets were placed on Sapient .

6,851 calls option purchases to be exact.

Why does that number matter? Because Sapient’s average trading volume had been less than 100 contracts for most days that year.

A spike from around 100 options contracts all the way up to over 6,800 in a 24 hour period.

I’m sure you can tell by now where this is going…

Three days later on November 3rd, Sapient saw its shares soar 43% after the company said it would be acquired by French ad giant Publicis.

The perfect timing didn’t escape many analysts…

“I would say that the jump in option prices on Oct. 29 is very unusual, and could indicate that information about this merger was revealed in the markets before the official announcement,” David Hait, president of OptionMetrics told Reuters.

It doesn’t take Sherlock Holmes to figure this mystery out. Did these traders have inside information? Of course!

Just like the man who made $16 million on Kraft in March and the trader that banked $900k on CernerCorp.

How did they get that information? I don’t know.

Is what they did legal? It’s hard to say.

Was it massively profitable? Clearly.

Can you or I get this info early too? Unfortunately… no.

I’m not writing to you today to offer you insider tips. That sort of stuff is best left to dark corners of the trading floors and the penthouse offices of Wall Street.

What I am writing you with today is the chance to do the next best thing:

An opportunity to spot these trading anomalies that occur under the radar, 10-15 times every single day in the markets… earlier than 99% of the general investing public.

Because you see, as much as they’d love for these types of trades to stay quiet and out of the public eye, even the most experienced insiders can’t hide them.

As soon as they execute one, a signal is sent out into the world that operates as a dead give away to what they’re doing.

TheStreet.com calls these signals “a great heads up” that big profits could be on the way.

The key is being able to spot them in time.

Because these huge bets insiders try to quietly place ahead of big news are some of the most reliable indicators of upcoming gains that I’ve ever come across in my career.

And that’s why I call these stealth events – “profit flares”.

Because you can think of them two ways:

- The absolutely abnormal amount of calls these traders bought far outweighed anything that Cerner, Kraft or Sapient usually trade in a given day. I consider that the equivalent of a flare gun shooting off from deep inside the market, alerting those that are able to see it to find where it came from, why it went off, and what to do next.

- And second, the profits that can be made by spotting and acting on these anomalies come fast and furious… just like a flare popping out of a fire.Now I’m not suggesting you’d make anywhere near a million dollars on one trade like the Cerner investor did (after all he had to pony up $350k to do so). But if you act quickly and intelligently, a profound amount of money can be made by picking up on the handful of “flares” that go off each day.

In fact today I’ll show you exactly how over the past 12 months I’ve seen these types of “flare” trades average returns of 12% each!

With individual gains like 157%… 70%… 65%… 100%… 46%… 53%… and even 200%!

And often times within a 24-hour turnaround time!

Today I’m going to show you exactly how to spot these “profit flares” when they shoot off on Wall Street.

Now you may think given the tens of millions of trades occurring each day that finding 10-15 isolated anomalies would be impossible.

But it’s not. Not with the power of the system I’ve established behind you.

I’ll also show you how to safely and intelligently capitalize on these flares so that you’re positioned to collect significant double digit returns on your money MULTIPLE TIMES each week.

Because it’s important you know…

- This isn’t risky day trading.

- It isn’t speculative penny stock hunting.

- It isn’t illegal insider activity either. Even though the initial profit flare may have been prompted by insiders acting on early information, everything I’ll show you is 100% above board and totally sanctioned by the SEC.

- And finally – this isn’t a complicated technical strategy that you’ll need a Masters in finance to execute.

In fact you can begin spotting and collecting gains off of profit flares almost immediately.

With nothing more than a few clicks of your mouse, or a couple minutes on the phone with your broker.

And just so you’re completely clear and comfortable with utilizing profit flares to build your wealth repeatedly – I’m going to explain to you exactly what they are, what drives them and how my system works, from A-Z today.

I also won’t take up too much of your time doing it.

Because when it comes right down to it, profit flares are fairly simple.

Here, I’ll even show you how I did with my own personal money when I first began using them myself…

How to Profit Like an Insider…

Without ANY Inside Knowledge

My name is Manny Backus.

And before I reveal how you can begin using these unique profit flares to pile up the gains in your portfolio on a weekly basis, I want you to know a few things about me…

I am not your average professional stock trader.

I’m not a broker or individual investment advisor of any type. I’ve never worked at a big bank or had any kind of securities license at all. Nor do I have the Ivy League MBA that most financial “experts” consider a requirement.

The bottom line is all of these things are great achievements and look good hanging up on your wall, but they don’t automatically make you a proficient trader.

What I do have is a tested intelligence quotient of 157. According to “IQ and the Wealth of Nations” by Richard Lynn, the average IQ of all United States residents is 98.

I also possess a killer instinct and a strategic mindset due to my early childhood training in the arena of international chess. But when I was 19, my passion for chess took a back seat to my obsession with online trading.

That’s when I realized my chess training had given me the tactical ability and power to focus on what’s needed to beat the markets day in and day out.

You see, chess is part tactics and part ability to focus and remain unemotional. In chess, the player is always trying to challenge himself… to try and guess the next move on the board.

In stock trading, the trader is doing much the same thing… always trying to figure out what stock will move next.

No matter what they may claim, no “expert” owns a crystal ball. The only way to truly know where a company will go next is to follow the indicators.

Some do it through fundamental or technical analysis. Others play off the news or seasonal trends.

All these methods have their place – but identifying “profit flares” early and making a strategic play based off of them is one of the safest, most lucrative indicators I’ve ever seen in my two decades of investing.

In fact, from October 2015 through October 2016, using profit flares (and a secret weapon I’ll share with you in a moment) I’ve seen a small group of investors have the opportunity to collect 12% on each trade they’ve used them.

With individual gains as high as 157%, 65%, 100% and more…

And with 78% accuracy on top of it!

Now past performance is no guarantee of future profits… please keep that in mind.

But I’ll put that track record up against any other in the industry and I’m ready to show you why.

So let’s not waste any more time…

125% in 24 Hours…

Note: what I’m about to tell you is not a hypothetical. I executed this trade in my own private portfolio with my own money.

On June 1st I placed a trade on global financial services company, Credit Suisse.

I made this move because of a profit flare I had pinpointed a couple weeks earlier.

Now because I couldn’t immediately identify the catalyst behind this flare, I waited those couple of weeks to verify this wasn’t a fluke.

But the flare kept going up, day after day. Investors with inside knowledge clearly were bullish on Credit Suisse.

So on June 1st I made the trade. I bought call options on Credit Suisse for 20 cents a contract.

The very next day those same call options were worth 45 cents apiece.

I quickly sold and banked 125% on my investment.

Just like that!

So what exactly was this profit flare that tipped me to make a quick move on Credit Suisse?

Well the spark that lights a profit flare is, as you may have guessed – unusual options activity (or UOA for short).

What makes it “unusual”? Think of it like this…

How to Spot a Profit Flare Before Anyone Else…

Let’s say every day you go into your local corner store to buy a coffee.

You usually notice there’s a tray of blueberry muffins on the counter.

Every day you see two or three missing, but there’s always plenty left. Then one day you go in and you notice they’re almost all gone.

Every day you see two or three missing, but there’s always plenty left. Then one day you go in and you notice they’re almost all gone.

The next day it’s the same thing… and the day after that.

Clearly people are suddenly wild about these muffins. There’s something going on because you never see this many muffins being sold.

It’s completely out of the ordinary!

So you decide to see what the fuss is about and you buy one for yourself.

And the minute you bite into it, you realize it’s the best muffin you’ve ever eaten!

But if you hadn’t noticed the unusual amount of muffins all of a sudden being sold, you never would have been able to experience it for yourself.

Unusual options activity works the very same way.

It’s very often an obvious “tell” that a big time potential move on the underlying stock of a company is about to take place.

A move that insiders have gotten wind of before anyone else.

This move in price could be caused by a merger announcement like with Kraft and Heinz… or a new contract being announced as with Cerner…

Whatever the reason, insiders will try to keep this info to themselves for as long as possible.

And it’s obvious why. They want to cash in on this news before anyone else catches wind of it.

The best way to do that? Buy a ton of call options on the belief that the stock is heading up.

Options trade in contracts, with each contract normally controlling 100 shares of the stock. So an option that trades 2,000 contracts would represent a controlling interest in 200,000 shares of stock (2,000 x 100=200,000).

Options are also far cheaper than buying actual shares of the company’s stock… they pose far less risk if the trade goes wrong… and their profit potential is infinitely higher as well.

That’s how an investor can turn $700k into $16 million in two weeks like that one trader did buying Kraft.

But these insiders can’t keep this secret forever.

And the moment they execute a massive order of call options, an amount that’s far out of the normal range that are traded in a day…

…then the profit flare goes up and those who see it now know too.

Yes – the top market insiders are essentially sending out a signal to the world alerting us to huge potential profits!

You’ve just got to know where to look for it…

You can see the flare I identified coming from Credit Suisse right below…

Because I was able to lock in on that UOA surrounding the company, I raked in a quick 125% in just one day’s time.

And thanks to the secret weapon I’ll tell you about in a moment, I can now show you how to spot an insider’s profit flare just like that, multiple times each week!

These types of unusual purchase spikes are usually initiated by hedge funds and institutional traders.

More than ever, hedge funds are using options on a daily basis.

Famed hedge fund manager Carl Icahn used options, not stock, to take his large positions in Netflix and Herbalife. Bill Ackman of Pershing Square Capital Management used mostly options to take a very big stake in Target.

These types of traders are the ultimate insiders. And if they take an unusually large position in a company, it’s safe to say they have great reason why.

And that’s exactly why you should be following the breadcrumbs they’re dropping towards big payouts!

And unusual options activity could be the biggest bread crumb of them all.

Multiple Flares Each Day = Multiple Potential Profits

As I mentioned before these market anomalies take place multiple times each day.

And in fact, UOA can occur on average 100 to 125 times during trading hours.

That may sound like a lot, but considering that tens of millions of trades are executed in any given day, you can see that 100 profit flares buried inside there would be incredibly hard to find.

But out of those 100 flares – only 10 to 15 of them are really worth your attention.

Those are the flares that offer both maximum safety and potential profits… in a relatively short amount of time.

Remember over the twelve months spanning October 2015 through October 2016, I’ve seen 72 of these profit flares show an average of 12% per trade.

With gains reaching as high as 200% on individual trades!

And while I’ll never guarantee that kind of profit, you can see how lucrative these opportunities really are – and many times you’re in and out in 24 hours!

And that’s not to say a 12% gain is the max you can see from a profit flare… as the 125% I collected on Credit Suisse proves.

So our goal is to uncover what the big players are doing and follow along with them in the most profitable manner possible. It requires knowledge, skill and diligence, but as you can see, the payoff can be enormous.

But you have to know EXACTLY what to look for.

You see you can’t just look for the biggest trades to discover the unusual aspect of unusual options activity.

You have to compare it to the average size trade for that particular stock. For example, 2,000 contracts traded in an Apple option would not be considered unusual, since Apple trades 100,000 option contracts or more daily.

But 2,000 contracts traded on a far less liquid company would certainly be unusual.

For our purposes, 3 to 4 times the normal options trading volume would qualify as UOA.

Sometimes however you’ll find UOA far greater than that…

The Inside Tip That Would Have Made You a Quick 26%…

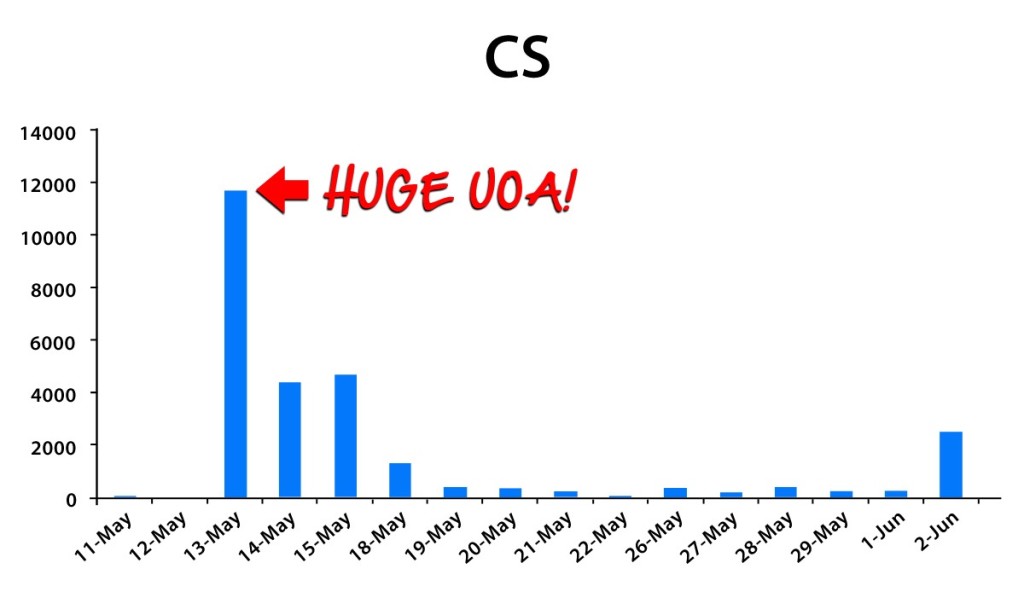

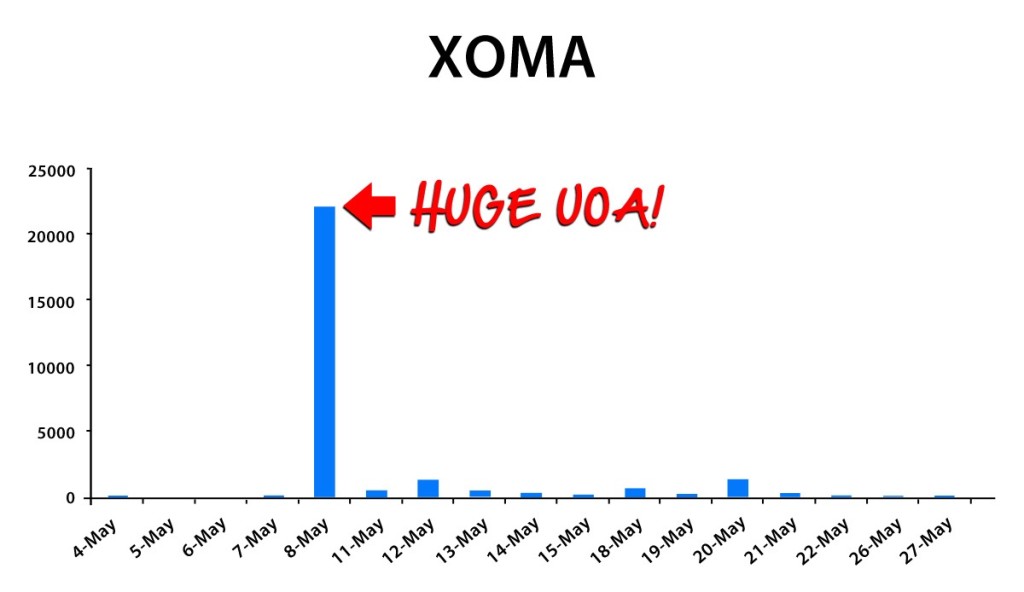

Take XOMA Corp for instance.

Back in the beginning of May, I zeroed in on some heavy UOA surrounding this pharmaceutical company.

On May 8th, one bold options trader put up $1.8 million of his money to purchase 17,000 XOMA September 4 calls.

XOMA on average on trades 1,315 calls each day. That means this trader bought nearly 17 times the normal amount of calls just on his own. Talk about unusual…

This was the equivalent of 20 profit flares being set off all at once!

So I looked into what was happening with XOMA and discovered they’d just received encouraging news from the FDA’s phase 2 trials of its new drug gevokizumab, designed to treat Behcet’s disease in the eye.

Positive FDA results always seem to send a stock soaring in the short term, so I waited a little longer to see if the UOA surrounding the company continued.

And for the next two weeks the heavy buying on XOMA carried on.

Most likely spurred on by the profit flare sent out by trader who purchased 17,000 contracts of course…

So on May 21st, I purchased September XOMA calls at 95 cents apiece.

By May 23rd, XOMA calls were still trading at quadruple their normal volume and the news on gevokizumab’s FDA trials was still positive.

The share price continued to climb, as did the value of my call options.

Now I’m not one to stick around a trade too long. I’d rather get out a little early than far too late.

So on June 3rd, I decided to sell the XOMA calls for $1.20 apiece.

A rock solid 26% gain in less than two weeks.

Full disclosure: If I had held on longer, I would have made even more money as XOMA’s share price soared for most of July in anticipation of its phase 3 FDA results.

However, those phase 3 results turned out very poorly and when they were announced on July 22nd, XOMA’s stock plunged 72% in a single day.

So I’ll take that 26% gain the profit flare tipped me off to and be quite happy with it!

And that’s precisely what you can expect on average when I show you the “secret weapon” I’ve commissioned to deliver you multiple profit flare opportunities each week.

Because as I mentioned earlier, over the last year these profit flares used in tandem with the secret weapon I’m about to reveal to you, have delivered profits 78% of the time!

And remember, we’re following the lead of the most experienced and successful big name traders on Wall Street.

Because once they tip us off with a profit flare, the next move is ours.

And 20% More, the Very Same Day!

I mentioned earlier that in order to safely and consistently profit from unusual options activity, there’s really only around 10-15 instances of it you’d want to focus on each day.

Now I certainly don’t place a trade on each one of those… I’ll do my research and distill the best opportunities down to only a handful I’ll put my money into each week.

That often means simultaneous opportunities to make money every 5 days!

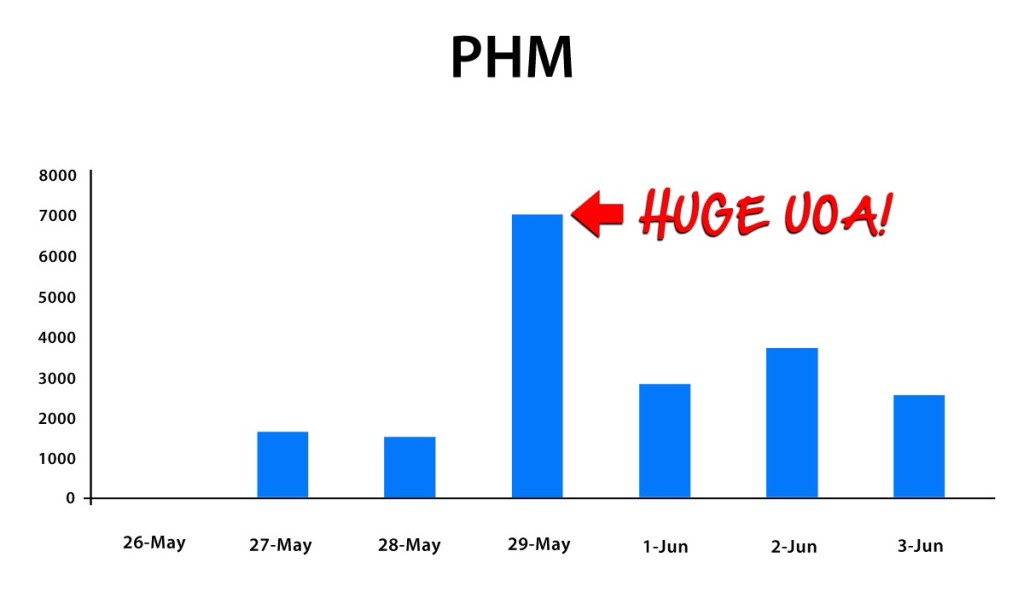

For instance, while I was only a couple days away from banking that 26% gain on XOMA, I also noticed some UOA on Pulte Group, the well-known U.S. homebuilder.

Traders were getting quite bullish on Pulte – to the tune of 7 times its daily option volume average.

This was in part to improving housing data across the country as the stock market kept hitting new heights.

So on June 1st, I bought Pulte calls at $1.37 apiece.

Then just two days on June 3rd, the same day I closed out my XOMA gain, I sold those Pulte calls for $1.65 apiece.

Meaning I banked another 20% gain on the very same day!

That means a simple $5,000 investment would have snagged you a quick $1,000 in just 48 hours.

Pulte’s shares dipped back down for the next week before rising up again.

But remember – a huge part of building wealth is ensuring safety!

That’s why I’ll take a 20% return on my money in two days any time. Especially when it’s paired with a 26% gain the same day.

That’s how you build wealth intelligently and securely. By collecting quick solid gains, multiple times every week… and exiting before any of that money could potentially come off the table.

And remember, that’s not to say that fast triple digit gains aren’t possible using UOA as an indicator either.

- One heads up investor banked 450% and pocketed $306,000 overnight off of an unusual options play last year on Merrimack Pharmaceuticals.

- This past June a trader snatched up 2,600 calls on Martha Stewart Living stock based as rumors of its acquisition by Sequential Brands Group broke. Those calls ended up netting 267%… worth $208,000 to the trader.

- On April 9th, options volume on GE was three times higher than average and the calls were outnumbering the put orders 2 to 1. The next day GE announced it was restructuring and its share price shot up 8%. June 26 calls on the company purchased on the 9th could have netted you as much as 688%!

Now many of these trades would have required you to have inside information in order to achieve those same kinds of massive returns.

But playing off the profit flares these instances of UOA provide us, you could get in cheaper AND safer and still collect triple digit gains!

These insider moves can power an everyday investor like you to consistent and reliable profits, week after week.

But the key is knowing HOW to spot them at the perfect time.

And that’s exactly what I’m going to show you how to do for yourself.

Revealed: Your Secret Weapon for Trading Like an Insider

As I mentioned earlier, I’m not a stock broker, a professional money manager or floor trader.

And I don’t have an MBA in business or economics.

Yet I’ve been able to harness the power of these profit flares to produce double and triple digit gains in my own portfolio.

Friends have asked how I’ve been able to do it and I’ll be honest – it hasn’t been easy.

With tens of millions of trades occurring each day on Wall Street, spotting an instance of UOA that warrants an investment can be time consuming and frustrating.

The old cliché of a needle in a haystack doesn’t even do it justice!

But after experiencing success with unusual options activity plays, I knew this was a truly lucrative way to trade like the ultimate Wall Street insiders, such as Carl Ichan does.

Now in 2002, I founded TradingTips.com a financial research firm recently named by Inc. Magazine as one of America’s 500 fastest growing private companies.

And serving as the CEO of tradingtips means that my personal time to care for my own portfolio is truly limited.

I also know when it pays to seek out the assistance of the top minds in a certain area.

That’s how I’ve built tradingtips into one of top financial research firms in the world today.

And it’s how I knew I’d be able to maximize the potential that profit flares offer to our readers.

That top mind is the “secret weapon” I’ve been telling you about.

His name is Tim Biggam and he’s agreed to serve as TradingTips chief UOA analyst and trading expert.

Tim’s spent over two decades in the options game and he’s one of the market’s most respected and experienced voices.

As a member of the Chicago Board of Options Exchange (CBOE), Tim was a top options Market Maker for over 3 years during extremely volatile market conditions.

For the next 20 years he worked for several successful private options and securities firms as their Chief Options Strategist before finally joining us at Tradingtips today.

He’s been featured by Reuters, Chicago Derivatives Desk, The Wall Street Journal Options Report, Barrons, TheStreet.com, Futures Industry, and Risk Magazine.

When I first saw Tim it was on one his weekly Bloomberg TV appearances.

I was immediately intrigued by his seemingly endless knowledge and success trading of profit flares.

I began following his work personally and before long, I contacted him asking him to join forces in assisting tradingtips readers with spotting and profiting from these stealth insider signals.

It took some convincing and good bit of negotiation but I’m thrilled he said yes!

So how exactly will Tim be helping investors like you?

As the chief analyst and editor of TradingTips brand new research service, Options Insider.

Cutting Edge Tech Pinpoints Multiple Profit Flares for You Every Single Week…

Options Insider is our newest weekly online trading service that will research, analyze and ultimately deliver the top profit flare opportunities in the market to you each week.

With Tim Biggam’s 20+ years of options trading expertise at your back, you’ll be alerted multiple times every week when unusual options activity has produced a profit opportunity that you’ll want to act on.

How does Tim identify when these top instances of UOA occur?

After all, I did liken the very best UOA opportunities to finding a needle in a haystack…

Well besides his wealth of real-world experience on the trading floor of the CBOE and in some of the most successful investment firms in the world, Tim also employs some of the most sophisticated options scanning technology I’ve ever seen.

This technology (which you can see above) is able to spot every instance of unusual options activity that takes place daily in the market… the second it occurs.

That means not a single potential profit flare can ever slip by Tim!

And it allows him to quickly research and dissect the UOA to determine whether or not there’s a safe and potentially lucrative trade to be had for Options Insider readers.

In fact he’s been perfecting his approach over the last few months to ensure that the moment the first Options Insider member comes on board, the potential for outsized gains is already huge.

In fact, over the last 12 months, Tim’s placed 92 profit flare trades… and 72 of them have come out as winners… a 78% win rate!

Those winners include gains of… 157%… 70%… 65%… 100%… 46%… 53%… and even 200%!

And the median hold time for those 92 trades was only 4 days!

The space-age tech that Tim uses every day to identify these UOA profit flares costs him over $25,000 a year to own and operate.

So as you can see he’s dead serious about identifying and cashing in on profit flares regularly… and being ridiculously successful at it!

And as a charter member of his brand new Options Insider research service, you can harness the power of Tim’s expertise AND the same technology that top hedge fund and banks use, to collect consistent returns… perhaps even has high as the 12% average gain he saw during the last 12 months.

I’ll give you the easy details on how to join Tim in profiting from these insider tip-offs in a moment, but first…

Here’s what you’ll receive as a charter member of Options Insider:

- Each week Tim Biggam will send you 3 to 5 profit flare recommendations based off of unusual options activity he’s been monitoring in the market. These alerts can arrive any time during trading hours, so make sure you’re monitoring your email throughout the day.

- Tim uses his top level technology to distill over 100 of these daily UOA events down to the absolute best 3 to 5 each week. This handful of recommendations represents the safest and most reliable opportunities you can find to follow the signals top insiders are sending up about a company’s short term prospects. And Tim’s Options Insider track showed an average of 12% on his closed trades from October 2015 to October 2016. While we can’t guarantee future performance, there’s no reason not to believe he can’t continue that profit run going forward!

- Just as he’ll send you an email alert when a trade is initiated, Tim will also send an alert when it’s time to close the trade for maximum potential gains. He’ll also contact you throughout the course of the trade with any news that could affect your profits.

- At the end of each week, Tim will send you a video recap of that week’s UOA and the profit flare opportunities it produced. He’ll also update you on any active positions and detail a plan of attack for the coming week.

Three to five opportunities every week, the same opportunities that have provided Tim’s readers with an average of 12% per trade inside his Options Insider portfolio over the last year.

With reliable insider information serving as your guide… the same information the top traders and hedge funds use to amass untold amounts of wealth on Wall Street!

That’s what drives Options Insider… and it could drive you to many of the most outsized gains of your life.

But as a brand new charter member that’s not all you’ll receive.

For a Limited Time: Charter Members Receive THREE FREE BONUSES

Because I’m so excited by the money-making potential of Tim Biggam’s Option Insider service, I want as many new readers as possible to try it for themselves.

That’s why I’m adding THREE exclusive bonuses to a charter membership.

So if you join today you’ll receive…

FREE: The Ultimate Guide to The World of Options Trading (a $69 value): Because Options Insider obviously requires you to be comfortable trading options, I want to make sure you’re 100% confident executing these investments.

That’s why I wrote this special e-book for you personally.

After all, with options, you can profit in a bull market, a bear market, or even a sideways market. You can use options to provide “insurance” for your portfolio, thus diminishing your risk—or you can leverage a little money into controlling a huge amount of stock. Simply put, options offer something for every-body. And while Options Insider is meant for experienced options traders, I’ll still cover all the basics for you as helpful refresher. Everything from long calls and short puts to multi-options strategies such as collars, spreads, straddles, and combinations.

So read on and learn how you too can profit and hedge just like the big boys on Wall Street. It’s easier than you might think!

FREE: “The Profit-Rich Options” Video Series (a $129 value): This three part video series is a crash course into how pit traders leverage options into consistent profits with as little risk as possible.

As I mentioned earlier, part of what I love about Tim’s profit flare opportunities is that he has 20+ years’ experience and top level technology behind him as he pinpoints and recommends his trades for Options Insider members.

That’s because the safety of my money and YOUR money is paramount to me. I love to make big gains… but I hate losing what I already have even more.

This video series will teach you a unique way to use options the same way high level traders do – to make oversized profits AND to reduce risk to the lowest possible degree.

![]()

Hi, I’m Tim Biggam…

![]()

To me, one the biggest advantages of using option strategies is the ability to take advantage of volatility. While the stock market has certainly struggled lately, but the option market continues to provide plenty of opportunities on a daily basis. Each day, I’m able to uncover numerous potentially lucrative trade ideas based on my professional grade option scanning technology. I then optimize the candidates, with only about 3-5 percent of the original candidates make it to end. It’s kind of like Navy Seal training for options.

If this seems like a lot of work and effort, it is. But the payoff is worth the pain. The final few opportunities that make it through have the best and biggest edge. The good news is that you don’t have to pay thousands a month for the professional option scanners, nor go through the daily rigors of screening each opportunity. I do all the tough stuff for you. I provide you a simple email highlighting the top tier trade idea, with clear instructions on how to place your trade, along with ongoing follow ups to manage the exit strategy.

Every day, it’s a bull market somewhere in the thousands of different options being traded. Trying to find those hidden gems requires lots of technology, hard work and perseverance but the rewards are absolutely worth the effort.

The three-part series can be accessed online immediately through a special password-protected website and it’s yours at no charge.

FREE: How to Profit from Unusual Options Activity by Tim Biggam (a $49 value):

Tim has put together this essential trading manual for you, which explains what he looks for when sorting through the market’s daily UOA… how he determines which 3 to 5 trades per week he’ll be sending you… and how to ensure you’re maximizing your profit potential on each one.

Make sure you read this manual before you place a single Options Insider trade!

So to recap you’ll receive:

- Up to 5 actionable profit flare recommendations each and every week… the same picks that proved to be worth an average of 12% each from October 2015 through October 2016.

- A real-time e-mail alerting you when to open the trade, regular e-mail updates throughout the trade and a real-time alert when it’s time to sell for maximum potential gains.

- A weekly Options Insider video recap that’ll keep you updated on any open trades as well as lay out the UOA Tim’s seeing going into the next week.

- THREE FREE BONUSES: The Ultimate Guide to The World of Options Trading e-book, “The Profit-Rich Options” Video Series and How to Profit from Unusual Options Activity by Tim Biggam… all worth a combined $247.

So with that much profit potential… that much top level options experience and technology guiding you… that many opportunities to make money each week… AND those three FREE bonuses…

… I’m sure you’re wondering what a charter membership to Options Insider will cost you.

The answer may surprise you.

Extremely Limited: Lock in Your Special Charter Price AND Risk-Free Guarantee…

Normally a sophisticated options trading service like this would cost you as much as $5,000 annually.

And to be completely honest – I’m certain we’ll be raising the price of Options Insider to up around that price point by the end of the year.

But as a charter member, I want to reward you for acting first.

That’s why for a limited time, charter members can receive Options Insider for 30 days, absolutely FREE.

Yes, you can test drive Tim’s service for yourself and receive as many as 20 profit flare opportunities at no charge!

I only ask that you pay the small $7.67 shipping and handling fee for your welcome kit that I’ll be sending you that will include Tim’s How to Profit From Unusual Options Activity manual.

Beyond that, you won’t be charged for the service for a full month.

If you’re satisfied with the level of research and the profit potential Tim’s recommendations provide you and decide to stay on, you’ll be automatically charged $197 a month for as long as you choose to stay an Options Insider member.

And that $197 a month price will be locked into your subscription.

Meaning that when we raise the price of Options Insider following our charter enrolment period, you will NOT be charged a single cent more – no matter how much the cost increases!

Your charter rate will be written in stone. And at any point if you want to discontinue your membership, simply let us know and we’ll stop billing you immediately, no questions asked.

It’s a remarkably affordable way to experience the profit power of Options Insider.

And remember, Tim’s track record in the last few months has shown rapid fire gains of 27%, 66%, 53%, 55%, 100%, 25%, 47% and even 157%!

And 72 out of his 92 profit flare trades have come up winners!

That means you can easily pay for your subscription with just a fraction of the gains from ONE trade… and still have as many as 19 additional trades to rack up as pure profit.

What You Need to Know to Start Profiting Tomorrow…

So let’s recap with a quick Q&A…

What is a profit flare?

A profit flare is a hidden signal sent up in the markets by high level insiders making unusually large options trades on companies they know have a potentially massive profit event about to occur.

What sets off a profit flare?

Unusual options activity based off of insider info lights a profit flare… meaning we’d see at least 3 to 4 times the normal option trading volume on a company.

How can you see a profit flare?

Given that they’re hidden inside the tens of millions of trades that occur each day on Wall Street, they’re essentially invisible to the naked eye. But Tim Biggam’s professional grade scanning technology is able to identify each and every flare in real time and then analyzes which ones are suitable for an average investor to pursue.

How much money can I make and how quickly will I make it?

Profit flares can be incredibly lucrative. Nothing is ever guaranteed when investing however. And past performance is no guarantee of future success. But triple digit gains are possible as you’ve seen and according to Tim’s Option Insider track record an average of 12% per trade is entirely realistic given what he saw during that 12 month span I told you about. Often these trades close out within 24 hours but most average around 4 days.

Are these trades safe?

With 20+ years of options trading experience under his belt and a low aversion to risk, Tim will work to eliminate any potential losing trades. His cutting edge software cuts the over 100 profit flares that go up in the market each day down to only 3 to 5 a week… meaning you’re only receiving the trades with the best opportunity to succeed.

Are they legal?

Yes, 100% legal. Although the information insiders are trading off of that prompts UOA may be gained illegally, there is nothing unlawful at all about following the clues they leave behind and profiting from them ourselves.

Are they reliable?

Profit flares occur every day, right under our noses. As long as the markets are open, the potential for another to light up is undoubtedly there. They can deliver reliable, consistent profits multiple times each week, without fail.

What else do you need to know?

You’ve got one of the nation’s finest options minds… working with the highest level of technology… to locate trades based off of information that comes straight from the most “plugged-in” players on Wall Street… every single day.

This is what Options Insider is all about.

And for a limited time you can lock in the lowest price we’ll ever offer this service for.

Plus you’ll have a full 30 days to test drive it, risk-free.

By the end of that first month, you may have already banked 10… 12… maybe even 20 winning trades in your portfolio.

So take advantage of this special offer today and become one of the first Options Insider members in the world:

And when the next profit flare goes up… this time you’ll know.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO FOLLOWING. PLEASE READ CAREFULLY**

DISCLAIMERS

DISCLOSURE. TradingTips.com, its managers, its employees, and assigns (collectively “The Company”) do not make any guarantee or warranty about what is advertised above. The Company is not affiliated with, nor does it receive compensation from, any specific security. While the Company will not engage in front-running or trading against its own recommendations, The Company and its managers and employees reserve the right to hold possession in certain securities featured in its communications. Such positions will be disclosed AND will not purchase or sell the security for at least two (2) market days after publication.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

FORWARD-LOOKING STATEMENT. As defined in the United States Securities Act of 1933 Section 27(a), as amended in the Securities Exchange Act of 1934 Section 21(e), statements in this communication which are not purely historical are forward-looking statements and include statements regarding beliefs, plans, intent, predictions or other statements of future tense.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the methodology or system will generate profits or ensure freedom from losses. The testimonials and examples used herein are exceptional results, which do not apply to the average member, and are not intended to represent or guarantee that anyone will achieve the same or similar results.

AFFILIATES. Some or all of the content provided in this communication may be provided by an affiliate of The Company. Content provided by an affiliate may not be reviewed by the editorial staff member. Our affiliates may have their own disclosure policies that may differ from The Company’s policy.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here . If you do not agree to the Terms of Use , please contact TradingTips.com. to discontinue receiving future communications.

© Tradingtips.com. All Rights Reserved.

Tradingtips.com is a division of Wealthpire, Inc.